Randomness#

Co-author

Prerequisites

Outcomes

Recall basic probability

Draw random numbers from numpy

Understand why simulation is useful

Understand the basics of Markov chains and using the

quanteconlibrary to study themSimulate discrete and continuous random variables and processes

# Uncomment following line to install on colab

#! pip install

Randomness#

We will use the numpy.random package to simulate randomness in Python.

This lecture will present various probability distributions and then use numpy.random to numerically verify some of the facts associated with them.

We import numpy as usual

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

Probability#

Before we learn how to use Python to generate randomness, we should make sure that we all agree on some basic concepts of probability.

To think about the probability of some event occurring, we must understand what possible events could occur – mathematicians refer to this as the event space.

Some examples are

For a coin flip, the coin could either come up heads, tails, or land on its side.

The inches of rain falling in a certain location on a given day could be any real number between 0 and \(\infty\).

The change in an S&P500 stock price could be any real number between \(-\) opening price and \(\infty\).

An individual’s employment status tomorrow could either be employed or unemployed.

And the list goes on…

Notice that in some of these cases, the event space can be counted (coin flip and employment status) while in others, the event space cannot be counted (rain and stock prices).

We refer to random variables with countable event spaces as discrete random variables and random variables with uncountable event spaces as continuous random variables.

We then call certain numbers ‘probabilities’ and associate them with events from the event space.

The following is true about probabilities.

The probability of any event must be greater than or equal to 0.

The probability of all events from the event space must sum (or integrate) to 1.

If two events cannot occur at same time, then the probability that at least one of them occurs is the sum of the probabilities that each event occurs (known as independence).

We won’t rely on these for much of what we learn in this class, but occasionally, these facts will help us reason through what is happening.

Simulating Randomness in Python#

One of the most basic random numbers is a variable that has equal probability of being any value between 0 and 1.

You may have previously learned about this probability distribution as the Uniform(0, 1).

Let’s dive into generating some random numbers.

Run the code below multiple times and see what numbers you get.

np.random.rand()

0.19893652321657773

We can also generate arrays of random numbers.

np.random.rand(25)

array([0.09224261, 0.00380292, 0.88661894, 0.21836773, 0.75123059,

0.62715458, 0.49798124, 0.71777992, 0.52175992, 0.74969673,

0.77075772, 0.70632526, 0.60936053, 0.99136534, 0.08782659,

0.31021466, 0.83267276, 0.10745435, 0.36450917, 0.15319594,

0.5701503 , 0.86370203, 0.71817689, 0.49742973, 0.66533947])

np.random.rand(5, 5)

array([[0.53083247, 0.26394665, 0.19407818, 0.04253022, 0.76541374],

[0.08116365, 0.33858832, 0.75166663, 0.57588238, 0.42100184],

[0.37189136, 0.23698401, 0.09359451, 0.86047435, 0.9800506 ],

[0.2427735 , 0.41221441, 0.86413776, 0.99571764, 0.884003 ],

[0.68896326, 0.83063677, 0.13113551, 0.4287521 , 0.84438494]])

np.random.rand(2, 3, 4)

array([[[0.19430503, 0.27241728, 0.21803597, 0.20294772],

[0.31331722, 0.09825175, 0.41128553, 0.78028173],

[0.31586515, 0.64167929, 0.42034541, 0.99229923]],

[[0.77263916, 0.03652876, 0.29748799, 0.23990471],

[0.90268935, 0.01421605, 0.90293716, 0.66208799],

[0.9870924 , 0.31008437, 0.56002042, 0.03971145]]])

Why Do We Need Randomness?#

As economists and data scientists, we study complex systems.

These systems have inherent randomness, but they do not readily reveal their underlying distribution to us.

In cases where we face this difficulty, we turn to a set of tools known as Monte Carlo methods.

These methods effectively boil down to repeatedly simulating some event (or events) and looking at the outcome distribution.

This tool is used to inform decisions in search and rescue missions, election predictions, sports, and even by the Federal Reserve.

The reasons that Monte Carlo methods work is a mathematical theorem known as the Law of Large Numbers.

The Law of Large Numbers basically says that under relatively general conditions, the distribution of simulated outcomes will mimic the true distribution as the number of simulated events goes to infinity.

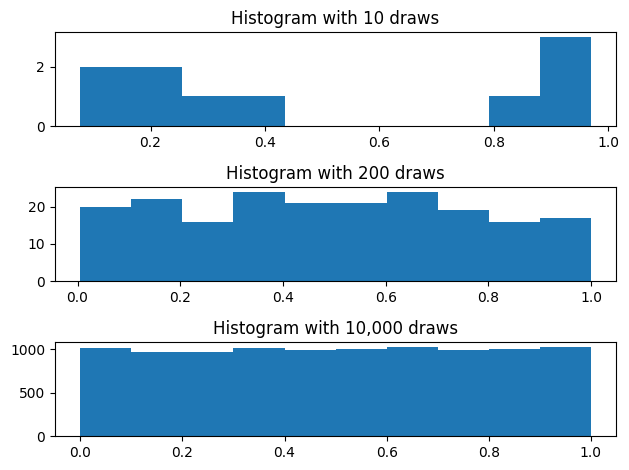

We already know how the uniform distribution looks, so let’s demonstrate the Law of Large Numbers by approximating the uniform distribution.

# Draw various numbers of uniform[0, 1] random variables

draws_10 = np.random.rand(10)

draws_200 = np.random.rand(200)

draws_10000 = np.random.rand(10_000)

# Plot their histograms

fig, ax = plt.subplots(3)

ax[0].set_title("Histogram with 10 draws")

ax[0].hist(draws_10)

ax[1].set_title("Histogram with 200 draws")

ax[1].hist(draws_200)

ax[2].set_title("Histogram with 10,000 draws")

ax[2].hist(draws_10000)

fig.tight_layout()

Exercise

See exercise 1 in the exercise list.

Discrete Distributions#

Sometimes we will encounter variables that can only take one of a few possible values.

We refer to this type of random variable as a discrete distribution.

For example, consider a small business loan company.

Imagine that the company’s loan requires a repayment of \(\$25,000\) and must be repaid 1 year after the loan was made.

The company discounts the future at 5%.

Additionally, the loans made are repaid in full with 75% probability, while \(\$12,500\) of loans is repaid with probability 20%, and no repayment with 5% probability.

How much would the small business loan company be willing to loan if they’d like to – on average – break even?

In this case, we can compute this by hand:

The amount repaid, on average, is: \(0.75(25,000) + 0.2(12,500) + 0.05(0) = 21,250\).

Since we’ll receive that amount in one year, we have to discount it: \(\frac{1}{1+0.05} 21,250 \approx 20238\).

We can now verify by simulating the outcomes of many loans.

# You'll see why we call it `_slow` soon :)

def simulate_loan_repayments_slow(N, r=0.05, repayment_full=25_000.0,

repayment_part=12_500.0):

repayment_sims = np.zeros(N)

for i in range(N):

x = np.random.rand() # Draw a random number

# Full repayment 75% of time

if x < 0.75:

repaid = repayment_full

elif x < 0.95:

repaid = repayment_part

else:

repaid = 0.0

repayment_sims[i] = (1 / (1 + r)) * repaid

return repayment_sims

print(np.mean(simulate_loan_repayments_slow(25_000)))

20229.523809523806

Aside: Vectorized Computations#

The code above illustrates the concepts we were discussing but is much slower than necessary.

Below is a version of our function that uses numpy arrays to perform computations instead of only storing the values.

def simulate_loan_repayments(N, r=0.05, repayment_full=25_000.0,

repayment_part=12_500.0):

"""

Simulate present value of N loans given values for discount rate and

repayment values

"""

random_numbers = np.random.rand(N)

# start as 0 -- no repayment

repayment_sims = np.zeros(N)

# adjust for full and partial repayment

partial = random_numbers <= 0.20

repayment_sims[partial] = repayment_part

full = ~partial & (random_numbers <= 0.95)

repayment_sims[full] = repayment_full

repayment_sims = (1 / (1 + r)) * repayment_sims

return repayment_sims

np.mean(simulate_loan_repayments(25_000))

20163.809523809523

We’ll quickly demonstrate the time difference in running both function versions.

%timeit simulate_loan_repayments_slow(250_000)

113 ms ± 654 µs per loop (mean ± std. dev. of 7 runs, 10 loops each)

%timeit simulate_loan_repayments(250_000)

5.29 ms ± 10.5 µs per loop (mean ± std. dev. of 7 runs, 100 loops each)

The timings for my computer were 167 ms for simulate_loan_repayments_slow and 5.05 ms for

simulate_loan_repayments.

This function is simple enough that both times are acceptable, but the 33x time difference could matter in a more complicated operation.

This illustrates a concept called vectorization, which is when computations operate on an entire array at a time.

In general, numpy code that is vectorized will perform better than numpy code that operates on one element at a time.

For more information see the QuantEcon lecture on performance Python code.

Aside: Using Class to Hold Parameters#

We have been using objects and classes both internal to python (e.g. list) from external libraries (e.g. numpy.array). Sometimes it is convenient to create your own classes to organize parameter, data, and functions.

In this section we will reimplement our function using new classes to hold parameters.

First, we rewrite simulate_loan_repayments so that instead of a collection of individual parameters, it takes in an object (titles params).

def simulate_loan_repayments_2(N, params):

# Extract fields from params object

r = params.r

repayment_part = params.repayment_part

repayment_full = params.repayment_full

random_numbers = np.random.rand(N)

# start as 0 -- no repayment

repayment_sims = np.zeros(N)

# adjust for full and partial repayment

partial = random_numbers <= 0.20

repayment_sims[partial] = repayment_part

full = ~partial & (random_numbers <= 0.95)

repayment_sims[full] = repayment_full

repayment_sims = (1 / (1 + r)) * repayment_sims

return repayment_sims

Any object which fulfills params.r, params.replayment_part and params.repayment_full will work, so we will create a few versions of this to explore features of custom classes in Python.

The most important function in a class is the __init__ function which determines how it is constructed and creates an object of that type. This function has the special argument self which refers to the new object being created, and with which you can easily add new fields. For example,

class LoanRepaymentParams:

# A special function 'constructor'

def __init__(self, r, repayment_full, repayment_part):

self.r = r

self.repayment_full = repayment_full

self.repayment_part = repayment_part

# Create an instance of the class

params = LoanRepaymentParams(0.05, 50_000.0, 25_000)

print(params.r)

0.05

The inside of the __init__ function simply takes the arguments and assigns them as new fields in the self. Calling the LoanRepaymentParams(...) implicitly calls the __init__ function and returns the new object.

We can then use the new object to call the function simulate_loan_repayments_2 as before.

N = 1000

params = LoanRepaymentParams(0.05, 50_000.0, 25_000)

print(np.mean(simulate_loan_repayments_2(N, params)))

40666.666666666664

One benefit of using a class is that you can do calculations in the constructor. For example, instead of passing in the partial repayment amount, we could pass in the fraction of the full repayment that is paid.

class LoanRepaymentParams2:

def __init__(self, r, repayment_full, partial_fraction = 0.3):

self.r = r

self.repayment_full = repayment_full

# This does a calculation and sets a new value

self.repayment_part = repayment_full * partial_fraction

# Create an instance of the class

params = LoanRepaymentParams2(0.05, 50_000.0, 0.5)

print(params.repayment_part) # Acccess the calculation

print(np.mean(simulate_loan_repayments_2(N, params)))

25000.0

39571.428571428565

This setup a default value for the partial_fraction so that we could also have called this with LoanRepaymentParams2(0.05, 50_000).

Finally, there are some special features we can use to create classes in python which automatically create the __init__ function, allow for more easily setting default values. The easiest is to create a dataclass (see documentation).

from dataclasses import dataclass

@dataclass

class LoanRepaymentParams3:

r: float = 0.05

repayment_full: float = 50_000

repayment_part: float = 25_000

params = LoanRepaymentParams3() # uses all defaults

params2 = LoanRepaymentParams3(repayment_full= 60_000) # changes the full repayment amount

# show the objects

print(params)

print(params2)

# simulate using the new object

print(np.mean(simulate_loan_repayments_2(N, params2)))

LoanRepaymentParams3(r=0.05, repayment_full=50000, repayment_part=25000)

LoanRepaymentParams3(r=0.05, repayment_full=60000, repayment_part=25000)

48685.71428571428

The @dataclass is an example of a python decorator (see documentation). Decorators take in a class (or function) and return a new class (or function) with some additional features. In this case, it automatically creates the __init__ function, allows for default values, and adds a new __repr__ function which determines how the object is printed.

Profitability Threshold#

Rather than looking for the break even point, we might be interested in the largest loan size that ensures we still have a 95% probability of profitability in a year we make 250 loans.

This is something that could be computed by hand, but it is much easier to answer through simulation!

If we simulate 250 loans many times and keep track of what the outcomes look like, then we can look at the the 5th percentile of total repayment to find the loan size needed for 95% probability of being profitable.

def simulate_year_of_loans(N=250, K=1000):

# Create array where we store the values

avg_repayments = np.zeros(K)

for year in range(K):

repaid_year = 0.0

n_loans = simulate_loan_repayments(N)

avg_repayments[year] = n_loans.mean()

return avg_repayments

loan_repayment_outcomes = simulate_year_of_loans(N=250)

# Think about why we use the 5th percentile of outcomes to

# compute when we are profitable 95% of time

lro_5 = np.percentile(loan_repayment_outcomes, 5)

print("The largest loan size such that we were profitable 95% of time is")

print(lro_5)

The largest loan size such that we were profitable 95% of time is

19571.428571428572

Now let’s consider what we could learn if our loan company had even more detailed information about how the life of their loans progressed.

Loan States#

Loans can have 3 potential statuses (or states):

Repaying: Payments are being made on loan.

Delinquency: No payments are currently being made, but they might be made in the future.

Default: No payments are currently being made and no more payments will be made in future.

The small business loans company knows the following:

If a loan is currently in repayment, then it has an 85% probability of continuing being repaid, a 10% probability of going into delinquency, and a 5% probability of going into default.

If a loan is currently in delinquency, then it has a 25% probability of returning to repayment, a 60% probability of staying delinquent, and a 15% probability of going into default.

If a loan is currently in default, then it remains in default with 100% probability.

For simplicity, let’s imagine that 12 payments are made during the life of a loan, even though this means people who experience delinquency won’t be required to repay their remaining balance.

Let’s write the code required to perform this dynamic simulation.

def simulate_loan_lifetime(monthly_payment):

# Create arrays to store outputs

payments = np.zeros(12)

# Note: dtype 'U12' means a string with no more than 12 characters

statuses = np.array(4*["repaying", "delinquency", "default"], dtype="U12")

# Everyone is repaying during their first month

payments[0] = monthly_payment

statuses[0] = "repaying"

for month in range(1, 12):

rn = np.random.rand()

if (statuses[month-1] == "repaying"):

if rn < 0.85:

payments[month] = monthly_payment

statuses[month] = "repaying"

elif rn < 0.95:

payments[month] = 0.0

statuses[month] = "delinquency"

else:

payments[month] = 0.0

statuses[month] = "default"

elif (statuses[month-1] == "delinquency"):

if rn < 0.25:

payments[month] = monthly_payment

statuses[month] = "repaying"

elif rn < 0.85:

payments[month] = 0.0

statuses[month] = "delinquency"

else:

payments[month] = 0.0

statuses[month] = "default"

else: # Default -- Stays in default after it gets there

payments[month] = 0.0

statuses[month] = "default"

return payments, statuses

We can use this model of the world to answer even more questions than the last model!

For example, we can think about things like

For the defaulted loans, how many payments did they make before going into default?

For those who partially repaid, how much was repaid before the 12 months was over?

Unbeknownst to you, we have just introduced a well-known mathematical concept known as a Markov chain.

A Markov chain is a random process (Note: Random process is a sequence of random variables observed over time) where the probability of something happening tomorrow only depends on what we can observe today.

In our small business loan example, this just means that the small business loan’s repayment status tomorrow only depended on what its repayment status was today.

Markov chains often show up in economics and statistics, so we decided a simple introduction would be helpful, but we leave out many details for the interested reader to find.

A Markov chain is defined by three objects:

A description of the possible states and their associated value.

A complete description of the probability of moving from one state to all other states.

An initial distribution over the states (often a vector of all zeros except for a single 1 for some particular state).

For the example above, we’ll define each of these three things in the Python code below.

# 1. State description

state_values = ["repaying", "delinquency", "default"]

# 2. Transition probabilities: encoded in a matrix (2d-array) where element [i, j]

# is the probability of moving from state i to state j

P = np.array([[0.85, 0.1, 0.05], [0.25, 0.6, 0.15], [0, 0, 1]])

# 3. Initial distribution: assume loans start in repayment

x0 = np.array([1, 0, 0])

Now that we have these objects defined, we can use the a MarkovChain class from the

quantecon python library to analyze this model.

import quantecon as qe

mc = qe.markov.MarkovChain(P, state_values)

We can use the mc object to do common Markov chain operations.

The simulate method will simulate the Markov chain for a specified number of steps:

mc.simulate(12, init="repaying")

array(['repaying', 'repaying', 'repaying', 'repaying', 'repaying',

'repaying', 'repaying', 'repaying', 'repaying', 'repaying',

'repaying', 'repaying'], dtype='<U11')

Suppose we were to simulate the Markov chain for an infinite number of steps.

Given the random nature of transitions, we might end up taking different paths at any given moment.

We can summarize all possible paths over time by keeping track of a distribution.

Below, we will print out the distribution for the first 10 time steps, starting from a distribution where the debtor is repaying in the first step.

x = x0

for t in range(10):

print(f"At time {t} the distribution is {x}")

x = mc.P.T @ x

At time 0 the distribution is [1 0 0]

At time 1 the distribution is [0.85 0.1 0.05]

At time 2 the distribution is [0.7475 0.145 0.1075]

At time 3 the distribution is [0.671625 0.16175 0.166625]

At time 4 the distribution is [0.61131875 0.1642125 0.22446875]

At time 5 the distribution is [0.56067406 0.15965937 0.27966656]

At time 6 the distribution is [0.5164878 0.15186303 0.33164917]

At time 7 the distribution is [0.47698039 0.1427666 0.38025302]

At time 8 the distribution is [0.44112498 0.133358 0.42551703]

At time 9 the distribution is [0.40829573 0.1241273 0.46757697]

Exercise

See exercise 2 in the exercise list.

Exercise

See exercise 3 in the exercise list.

Continuous Distributions#

Recall that a continuous distribution is one where the value can take on an uncountable number of values.

It differs from a discrete distribution in that the events are not countable.

We can use simulation to learn things about continuous distributions as we did with discrete distributions.

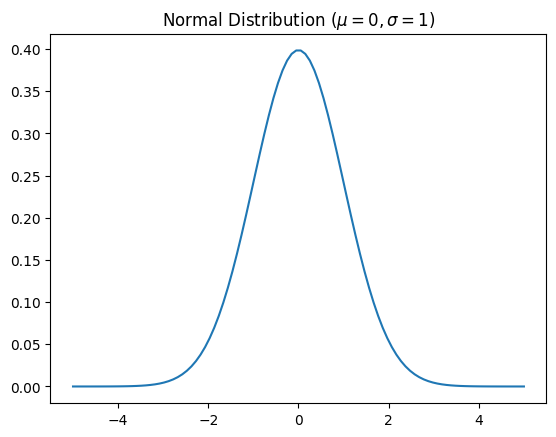

Let’s use simulation to study what is arguably the most commonly encountered distributions – the normal distribution.

The Normal (sometimes referred to as the Gaussian distribution) is bell-shaped and completely described by the mean and variance of that distribution.

The mean is often referred to as \(\mu\) and the variance as \(\sigma^2\).

Let’s take a look at the normal distribution.

# scipy is an extension of numpy, and the stats

# subpackage has tools for working with various probability distributions

import scipy.stats as st

x = np.linspace(-5, 5, 100)

# NOTE: first argument to st.norm is mean, second is standard deviation sigma (not sigma^2)

pdf_x = st.norm(0.0, 1.0).pdf(x)

fig, ax = plt.subplots()

ax.set_title(r"Normal Distribution ($\mu = 0, \sigma = 1$)")

ax.plot(x, pdf_x)

[<matplotlib.lines.Line2D at 0x7f4633fe2610>]

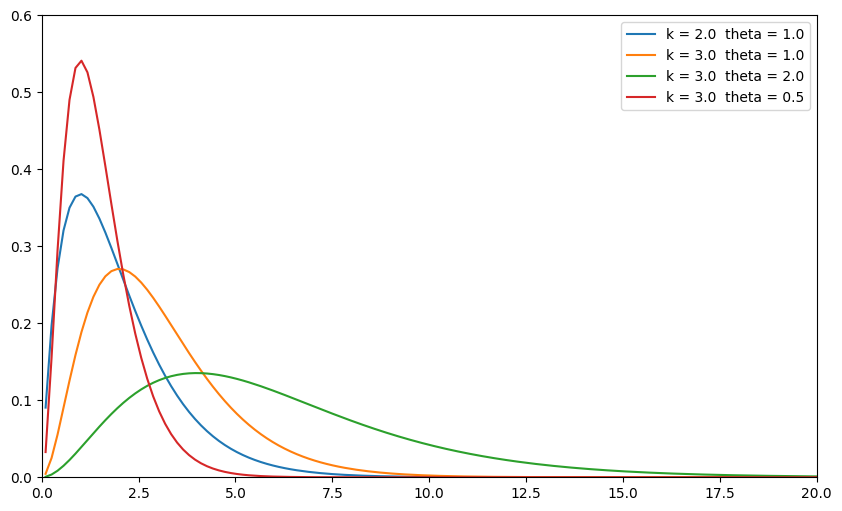

Another common continuous distribution used in economics is the gamma distribution.

A gamma distribution is defined for all positive numbers and described by both a shape parameter \(k\) and a scale parameter \(\theta\).

Let’s see what the distribution looks like for various choices of \(k\) and \(\theta\).

def plot_gamma(k, theta, x, ax=None):

if ax is None:

_, ax = plt.subplots()

# scipy refers to the rate parameter beta as a scale parameter

pdf_x = st.gamma(k, scale=theta).pdf(x)

ax.plot(x, pdf_x, label=f"k = {k} theta = {theta}")

return ax

fig, ax = plt.subplots(figsize=(10, 6))

x = np.linspace(0.1, 20, 130)

plot_gamma(2.0, 1.0, x, ax)

plot_gamma(3.0, 1.0, x, ax)

plot_gamma(3.0, 2.0, x, ax)

plot_gamma(3.0, 0.5, x, ax)

ax.set_ylim((0, 0.6))

ax.set_xlim((0, 20))

ax.legend();

Exercise

See exercise 4 in the exercise list.

Exercises#

Exercise 1#

Wikipedia and other credible statistics sources tell us that the mean and variance of the Uniform(0, 1) distribution are (1/2, 1/12) respectively.

How could we check whether the numpy random numbers approximate these values?

Exercise 2#

In this exercise, we explore the long-run, or stationary, distribution of the Markov chain.

The stationary distribution of a Markov chain is the probability distribution that would result after an infinite number of steps for any initial distribution.

Mathematically, a stationary distribution \(x\) is a distribution where \(x = P'x\).

In the code cell below, use the stationary_distributions property of mc to

determine the stationary distribution of our Markov chain.

After doing your computation, think about the answer… think about why our transition probabilities must lead to this outcome.

# your code here

Exercise 3#

Let’s revisit the unemployment example from the linear algebra lecture.

We’ll repeat necessary details here.

Consider an economy where in any given year, \(\alpha = 5\%\) of workers lose their jobs, and \(\phi = 10\%\) of unemployed workers find jobs.

Initially, 90% of the 1,000,000 workers are employed.

Also suppose that the average employed worker earns 10 dollars, while an unemployed worker earns 1 dollar per period.

You now have four tasks:

Represent this problem as a Markov chain by defining the three components defined above.

Construct an instance of the quantecon MarkovChain by using the objects defined in part 1.

Simulate the Markov chain 30 times for 50 time periods, and plot each chain over time (see helper code below).

Determine the average long run payment for a worker in this setting

Hint

Think about the stationary distribution.

# define components here

# construct Markov chain

# simulate (see docstring for how to do many repetitions of

# the simulation in one function call)

# uncomment the lines below and fill in the blanks

# sim = XXXXX.simulate(XXXX)

# fig, ax = plt.subplots(figsize=(10, 8))

# ax.plot(range(50), sim.T, alpha=0.4)

# Long-run average payment

Exercise 4#

Assume you have been given the opportunity to choose between one of three financial assets:

You will be given the asset for free, allowed to hold it indefinitely, and keeping all payoffs.

Also assume the assets’ payoffs are distributed as follows:

Normal with \(\mu = 10, \sigma = 5\)

Gamma with \(k = 5.3, \theta = 2\)

Gamma with \(k = 5, \theta = 2\)

Use scipy.stats to answer the following questions:

Which asset has the highest average returns?

Which asset has the highest median returns?

Which asset has the lowest coefficient of variation (standard deviation divided by mean)?

Which asset would you choose? Why?

Hint

There is not a single right answer here. Be creative and express your preferences.

# your code here